child tax credit 2022 extension

17 for those who still need to file their 2021 tax returns. ANY hope of receiving a child tax credit payment in January 2022 is slowly slipping away as Congress holds.

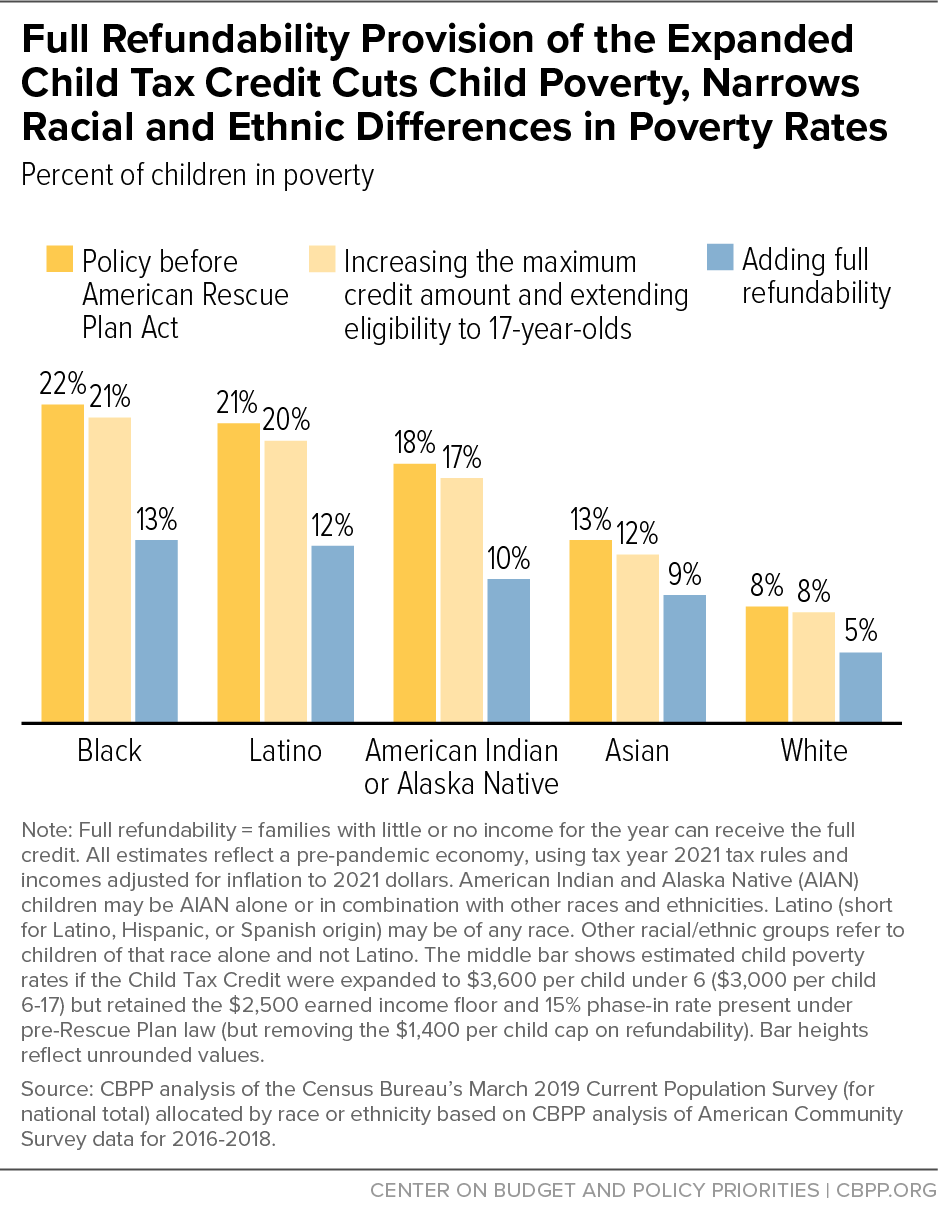

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

However Republican Senators Mitt Romney Richard Burr and Steve Daines sponsored a plan offering families up to 350 a month or 4200 per year.

. Budget hawks worry that a one-year extension is a. Will continue into 2022. Learn More at AARP.

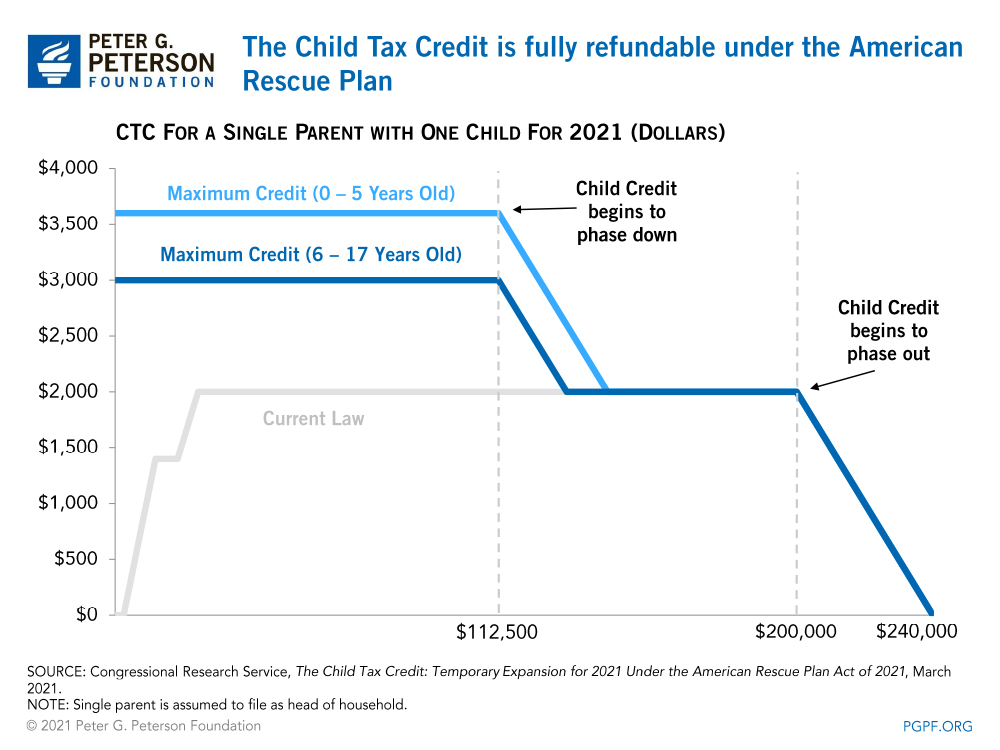

0 Federal 1499 State. Ad File a Late 2021 Tax Return Directly to the IRS. Democrats increased the tax credit to 3000 per child age 6-17 and 3600 per child 5 and under this year.

Get Your Past-Due Taxes Done Today. Budget hawks worry that a one-year extension is a. Have a qualifying child.

Democrats increased the tax credit to 3000 per child age 6-17 and 3600 per child 5 and under this year. Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. IRS Free File remains open until November 17 for those who.

One provision tens of millions of American families likely want to know is whether the expanded child tax credit implemented in July will continue into 2022As part of a COVID relief bill Democrats increased the tax credit to 3000 per child age 6-17 and 3600 per child. Child tax credit extension 2022 when is the deadline and will there be payments next year. Child Tax Credit 2022 Families can claim direct payments worth up to 3600 due to IRS mistake see if you qualify.

1406 ET Dec 27 2021. Will continue into 2022. The child tax credit benefit under the American Rescue Plan begins to phase out at incomes of 75000 for individuals 112500 for heads of household and 150000 for married couples.

Payment 1 is due on April 18 2022. The child tax credit CTC will return to at 2000 per child in 2022. The credit has been found to be effective at reducing poverty.

One question tens of millions of Americans are asking is whether the monthly child tax credit that was put in place during the COVID-19 pandemic rescue will be extended into 2022 as part of the bill. IRS Free File remains open until Nov. The quarterly payment schedule for the estimated tax payments in 2022 is as follows.

Todays WatchBlog post looks at our work on COVID-19 payments to individuals including the Child Tax Credit and next steps for. These payments were part of the American Rescue Plan a 19 trillion dollar. Payment 3 is due on September 15 2022.

2022 Child Tax Credit Extension2022 Child Tax Credit Extension. The table below shows the. As Tax Day Approaches Bennet Calls for Extension of the Expanded Child Tax Credit.

IR-2022-179 October 14 2022 The Internal Revenue Service reminds taxpayers today that those who requested an extension of time to file their 2021 income tax return that the deadline is Monday October 17. The enhanced Child Tax Credit payments where distributed last year from July through December. Payment 2 is due on June 15 2022.

6 Often Overlooked Tax Breaks You Dont Want to Miss. These IRS pages irsgovcoronavirusEIP and ChildTaxCreditgov have more information on how to complete and submit a tax return. Child Tax Credit extension.

The Internal Revenue Service reminds taxpayers today who requested an extension of time to file their 2021 income tax return that the deadline is Monday Oct. Budget restraints only allowed the. However that only applies to the monthly payout of the expanded.

935 ET Dec 29 2021. As Congress failed to agree on a Child Tax Credit extension payments will return to 2000 for 2022. Families must have at least 3000 in earned income to claim any portion of the credit and can receive a refund worth 15 percent of earnings above 3000 up to 1000 per child.

As of right now the 2022 child tax credit which you would get when you file in 2023 is set to go back to 2000 for each. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. The child tax credit benefit under the American Rescue Plan begins to phase out at incomes of 75000 for individuals 112500 for heads of household and 150000 for married couples.

Filed before August 31 2022 or if they have filed an extension file before the extended filing due date of October 17 2022. Ad Download Or Email Cranesville More Fillable Forms Register and Subscribe Now. This money was authorized by the american rescue plan act which.

The monthly payments were up to 250 or 300 per child for a period of six months. Budget hawks worry that a one-year extension is a. The US Tax Filing Deadline was April 18 2022.

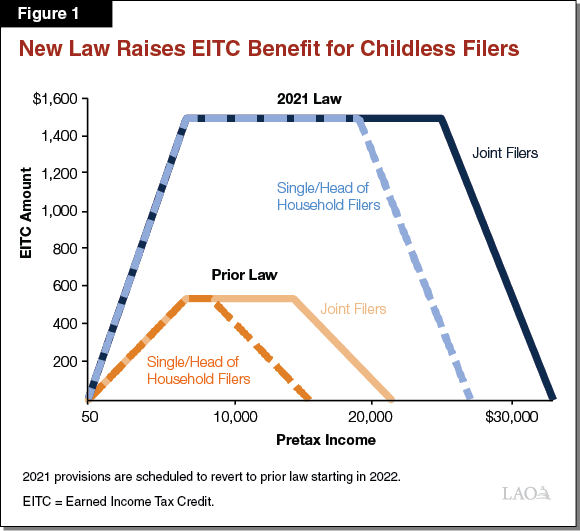

As Tax Day approaches on April 18 Bennet also highlighted that eligible families can claim the second half of their expanded CTC as well as their full expanded Earned Income Tax Credit EITC and Child and Dependent Care Tax Credit CDCTC by filing their 2021 tax. Will continue into 2022. Democrats increased the tax credit to 3000 per child age 6-17 and 3600 per child 5 and under this year.

Advance payments of the enhanced child tax credits were sent to people from July to December 2021. In Remarks on the Senate Floor Bennet Emphasized How 21. How much have gas prices increased in 2022.

The Child Tax Credit S Extra Benefits Are Ending Just As More Parents Are Scrambling For Child Care The New York Times

Will The Monthly Child Tax Credit Be Extended Next Year

Child Tax Credit 2022 What Changes Will There Be In The New Tax Season As Usa

Child Tax Credit 2022 Monthly Payment Still Uncertain 11alive Com

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

The Extended Child Tax Credit Is Dead But Could Democrats Force A Comeback 19fortyfive

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions

Opinion Robert E Rubin And Jacob J Lew A Plan To Help Kids Without Increasing Inflation The New York Times

Biden Still Hopes To Extend The Child Tax Credit The National Interest

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Opinion For Our Children And Our Future We Must Fight To Extend The Child Tax Credit Kentucky News

Tax Credit Expansions In The American Rescue Plan

Citizen Voice Extend The Monthly Child Tax Credit With Or Without Bbb

Child Tax Credit Payments 2022 Is There A Plan B If They Are Not Extended Next Year Marca