private reit tax advantages

If those werent enough reasons to consider investing in a REIT one should also consider the diversification advantages that a REIT can offer such as multiple tenants multiple properties a diverse tenant mix and geographic diversity. An entity becomes a REIT by making a tax election and satisfying certain requirements.

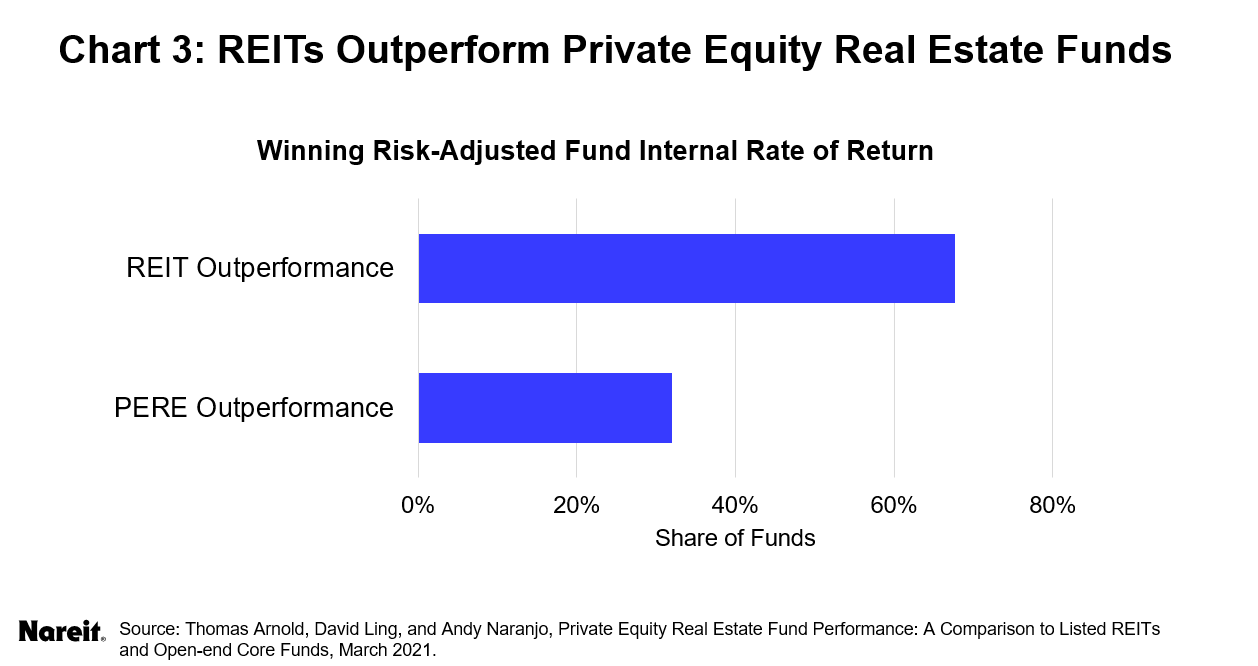

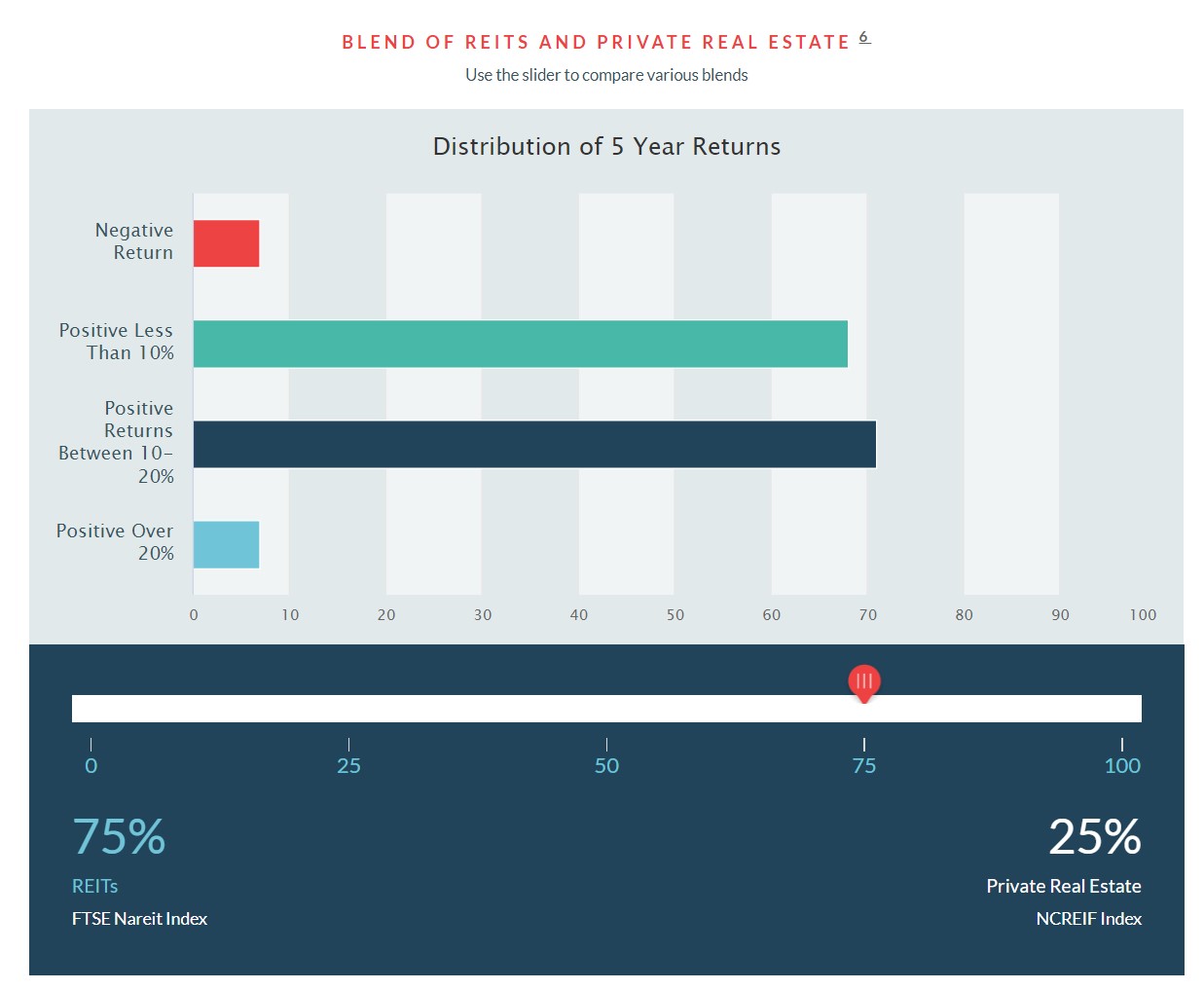

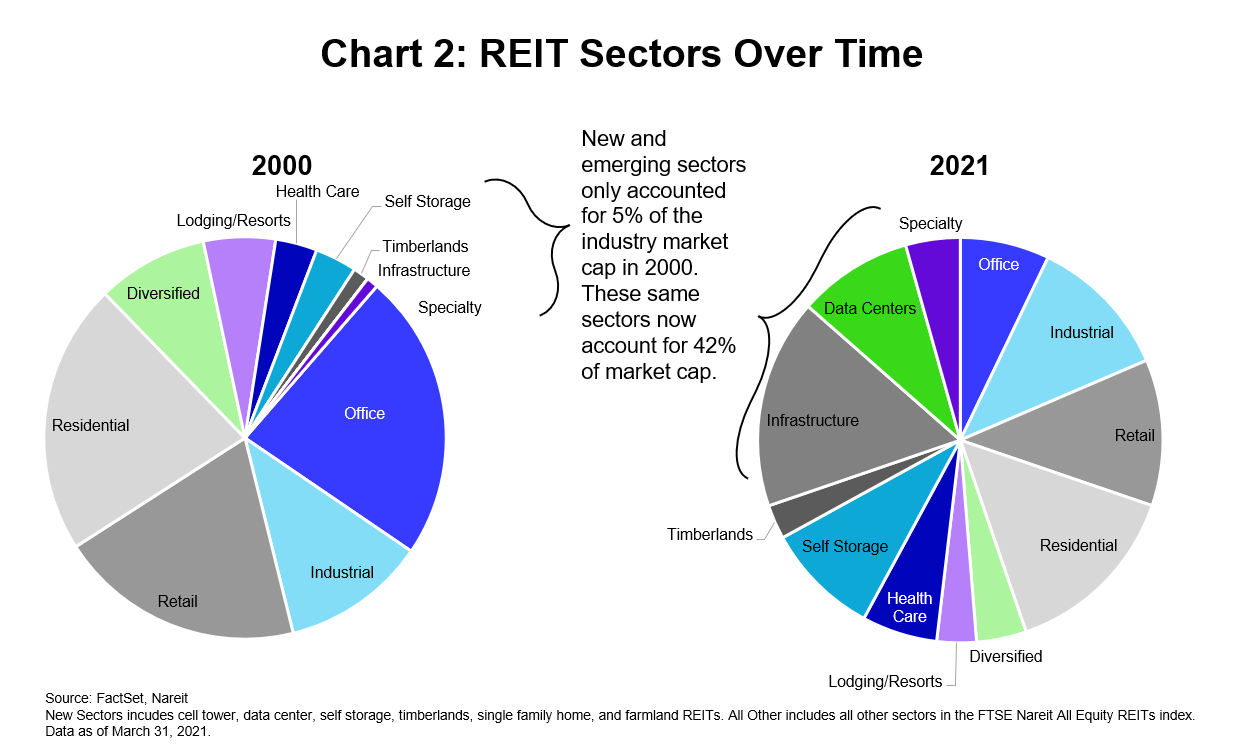

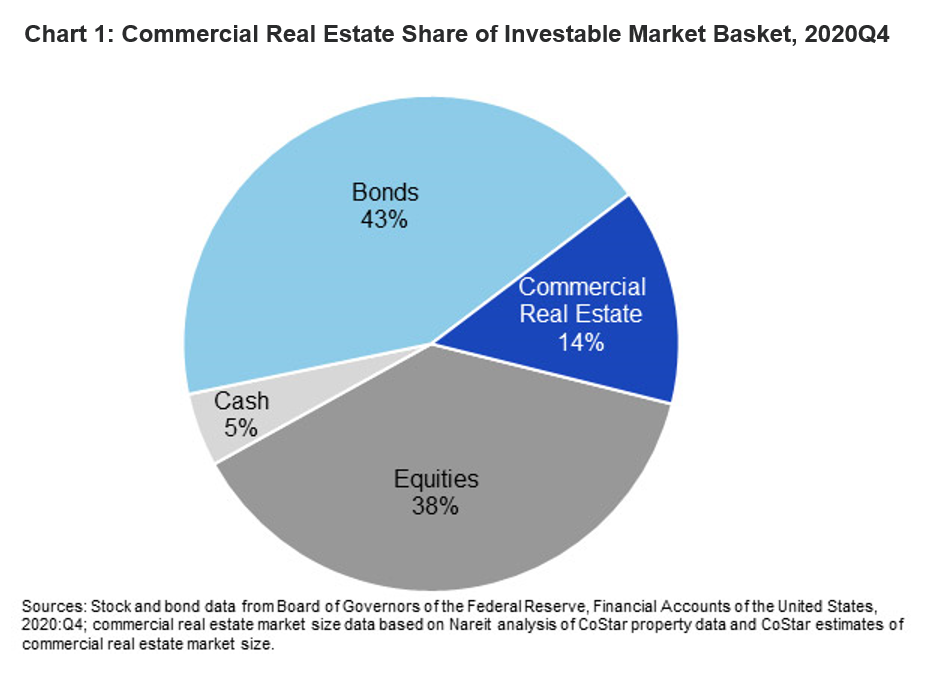

The Role Of Real Estate In Pension Funds Nareit

Acquisition and Operational Expertise.

. Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets. Lack of transparency -- Private REITs are not subject to the same regulatory scrutiny as public REITs they are actually exempt from SEC registration so there are plenty of opportunities for. This is one of the biggest tax advantages of REIT investing.

Than partnerships the use of a REIT may afford investors certain tax advantages. Private Equity Real Estate investments are structured in a tax-efficient manner. And foreign parties may be structured as a private REIT to enable the foreigner to avoid capital gains andor withholding taxes upon the sale of its REIT shares3 This can be accomplished by selling the shares of the REIT to a prospective buyer instead of the property itself.

REIT investors can deduct up to 20 of ordinary dividends before income tax is. Specifically REIT profits pass through untaxed to shareholders via dividends. The 199A tax deduction is spurring interest for real estate investors to move their properties into REITs in order to qualify for the 20 percent deduction.

The primary tax benefit of a REIT is the avoidance of what is called double taxation that is the payment of corporate tax and personal tax on the same income. REIT investors can deduct up to 20 of ordinary dividends before income tax is assessed. Like REITs a private equity real estate investment comes with impressive benefits.

2 Distributions are not guaranteed and may be funded from sources other than cash flow from operations including borrowings offering proceeds the sale of our assets and repayments of our real estate debt investments. IMGCAP1Real estate investment trusts were originally created to permit tax-efficient public investment in real estate but REITs have also found wide use as private vehicles. A benefit of investing in a fund with exposure to multiple properties is built-in diversification without the headache of multiple state income tax filings.

REITs provide unique tax advantages that can translate into a steady stream of income for investors and higher yields than what they might earn in fixed-income markets. Broadly speaking a company is first taxed at the corporate level and when that income is distributed to investors it is taxed again on a personal level. In its simplest tax form a REIT functions like a hybrid of the two and provides the best of both worlds.

Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. REIT investors can deduct up to 20 of ordinary dividends before income tax is. There are a couple of reasons that partnerships are becoming more interested in REITs.

The list below summarizes a few of the main advantages of starting a private REIT. Potential tax benefits of private reits for hedge funds and private equity funds by james d. Guide To Reits Reit Tax Advantages More Private Reits Maximize Qbi Deduction Dallas Business Income Tax Services New Tax Act Provides Substantial Tax Savings To Reit.

The identification selection acquisition and operation of a commercial real. Individual REIT shareholders can deduct 20 of the taxable REIT dividend income they receive but. Tax advantage of REITs.

The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates. Ordinary dividends from a REIT are not subject to foreign withholding. One significant advantage of investing in a private reit is its correlation has been historically low to the marketsthe price of private reit units is solely based on the actual appraised value of the real estate holdings which generally translates to a lack of fluctuation in response to public market.

Moreover there are a number of situations where a private REIT can be used to obtain tax advantages. In addition REIT investors benefit from a 20 rate reduction to individual tax rates on the ordinary income portion of distributions. Be no more than 50.

The income generated by REITs is not taxed on the corporate level and is instead taxed only on the individual shareholder level. Tax benefits of REITs. In particular a REITs assets must be primarily real estate and its income primarily derived from.

Entities qualifying for REIT status under the tax code receive preferential tax treatment. Borrowing also increases the risk of loss and exposure to negative economic effects. The buyer can then liquidate the REIT tax-free as.

REITs function like a blocker corporation in a real estate investment fund so setting up the REIT as the investment entity reduces the number of entities needed in the structure. One significant advantage of investing in a private REIT is its correlation has been historically low to the marketsthe price of private REIT units is solely based on the actual appraised value of the real estate holdings which generally translates to a lack of fluctuation in response to public market volatility.

Investing In Listed Infrastructure Nuveen

Four Differences Between Real Estate Syndications And Real Estate Investment Trusts

Investing In Listed Infrastructure Nuveen

What Are Spacs And Should You Invest In Them Money For The Rest Of Us

Who S To Blame For High Housing Costs It S More Complicated Than You Think

Investing In Listed Infrastructure Nuveen

Understanding Real Estate Finance The Advantages And Disadvantages Of A Non Traded Reit

The Role Of Real Estate In Pension Funds Nareit

The Role Of Real Estate In Pension Funds Nareit

What Is The Bc Ndp Doing To Protect Renters From Real Estate Investment Trusts Reits Adam Olsen Mla For Saanich North And The Islands

The Role Of Real Estate In Pension Funds Nareit

Integrated Liquidity Management For Private Markets Programs Neuberger Berman

Create Massive Leverage Through Passive Real Estate Investing Video Real Estate Investing Investing Real Estate Investor

:max_bytes(150000):strip_icc()/100371480-5bfc3974c9e77c0026b8cb99.jpg)